The Single Strategy To Use For Offshore Wealth Management

Wiki Article

How Offshore Wealth Management can Save You Time, Stress, and Money.

Table of Contents3 Easy Facts About Offshore Wealth Management ShownThe 6-Minute Rule for Offshore Wealth ManagementThe 7-Minute Rule for Offshore Wealth ManagementThe 30-Second Trick For Offshore Wealth ManagementThe Ultimate Guide To Offshore Wealth Management

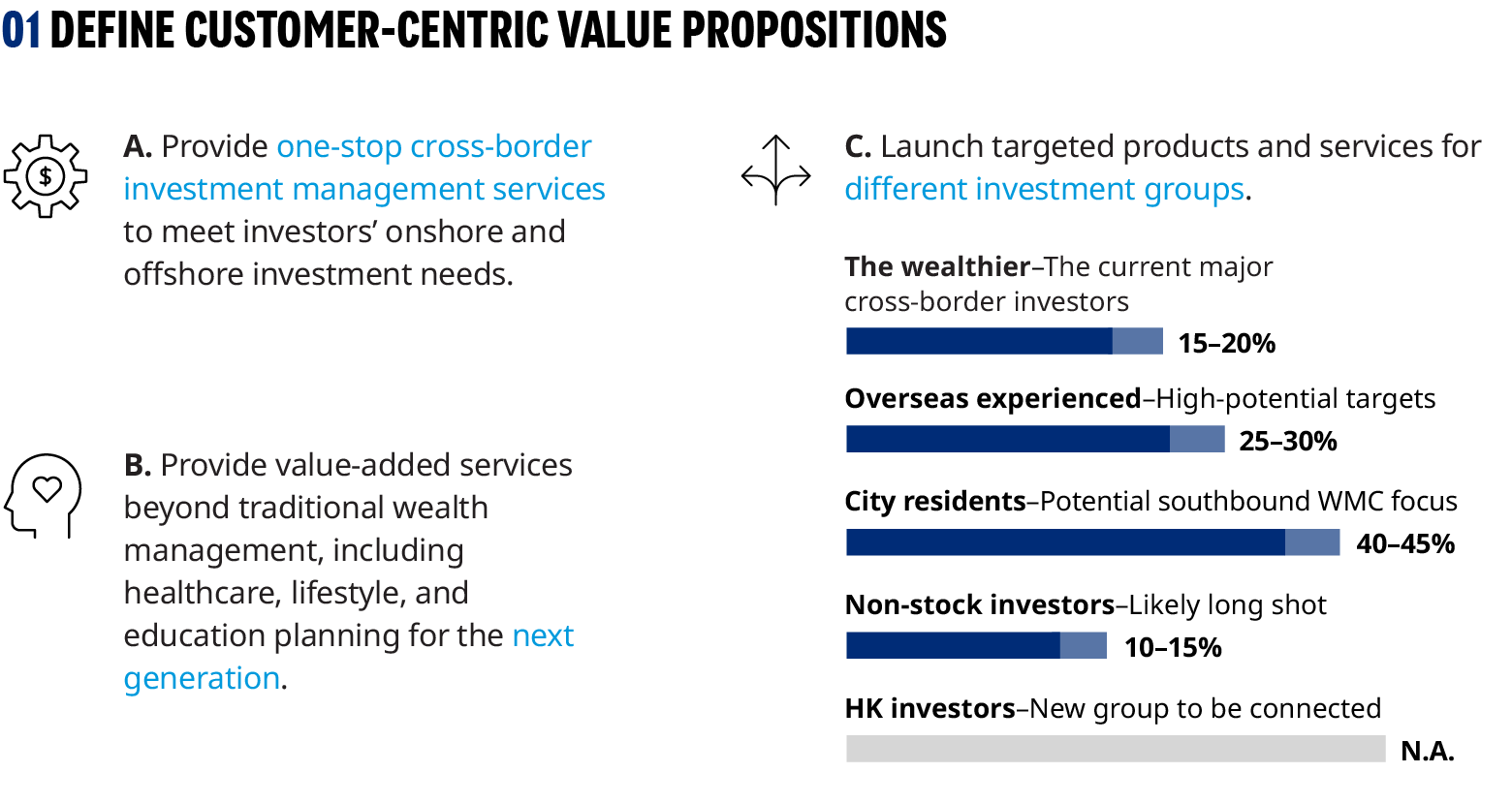

Tax rewards are presented as one way of encouraging immigrants to invest as well as consequently raise economic tasks. Spending in overseas wealth monitoring is an attractive chance to satisfy the demands of the richest of financiers. If you agree to spend your assets in an overseas account, you can take advantage of a more comprehensive series of investments, property security, as well as tax advantages.

capitalists give little idea to the often extensive impact of taxes on their estate. U.S. government inheritance tax can diminish the value of a profile, particularly when celebrations sharing a joint account, like a wedded couple, have actually passed away. For non-U.S. resident customers, an exemption of $60,000 is commonly permitted versus the value of assets consisted of in the U.S.

Beyond that, the united state imposes a 26% inheritance tax on the assets of departed non-residents, which gets back at steeper for larger estates. In this light, managing and structuring a profile to reduce the impact of inheritance tax may be more important than revenue, dividends, and funding gains tax obligations. The united state

How Offshore Wealth Management can Save You Time, Stress, and Money.

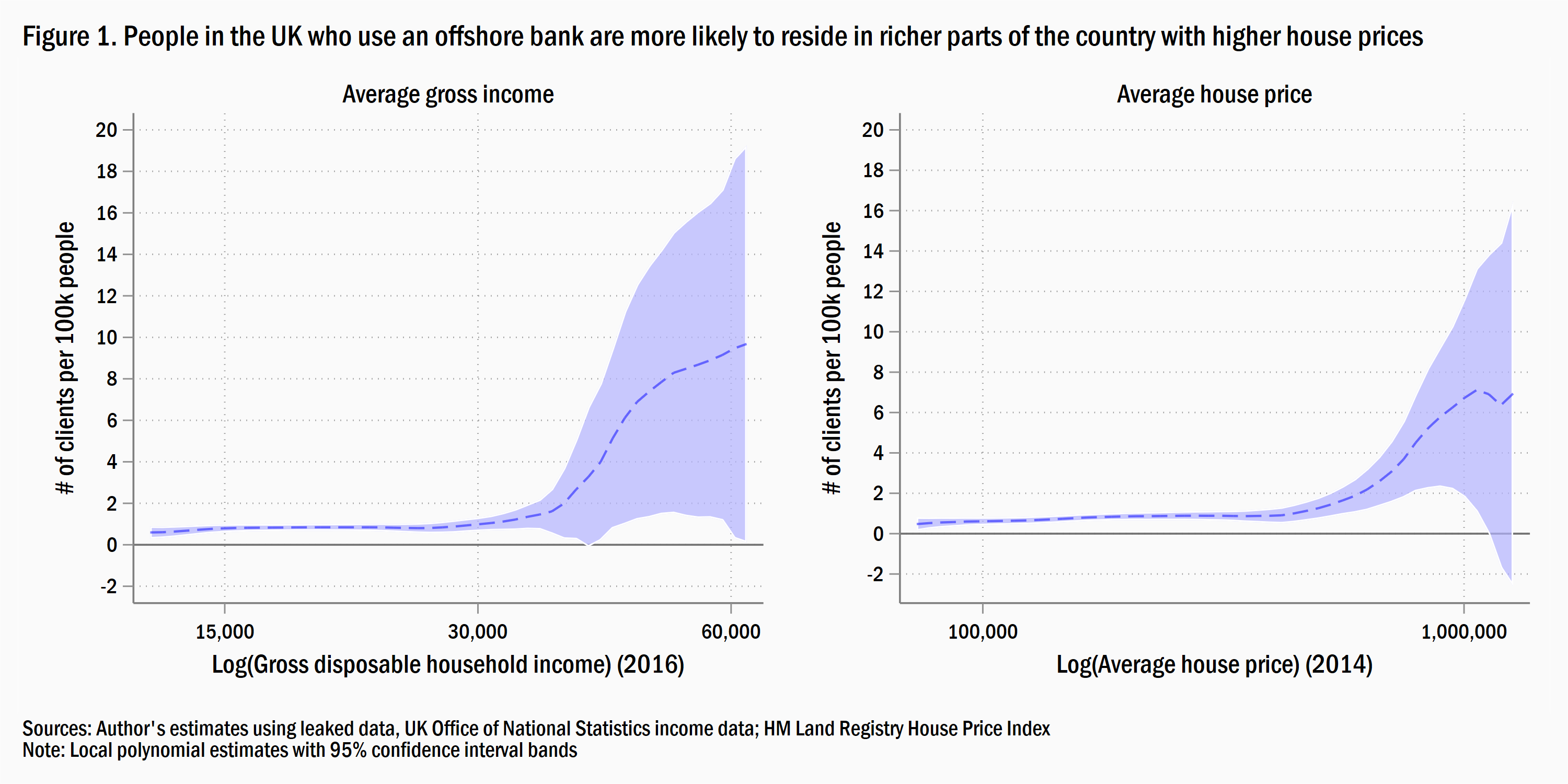

Offshore investing is typically demonized in the media, which paints a photo of tax-evading investors unlawfully stashing their cash with some dubious firm found on a rare Caribbean island. While it's true that there will constantly be instances of shady offers, the huge bulk of overseas investing is flawlessly lawful.Drawbacks include raising governing analysis on a global scale and also high prices related to overseas accounts. Offshore investing, in spite of its questionable online reputation, is a legal, reliable way to purchase entities that are only readily available outside your house nation. There are numerous reasons people spend offshore: Many countries (referred to as tax havens) deal tax obligation rewards to foreign capitalists.

Getting My Offshore Wealth Management To Work

For a tiny country with very few resources and also a tiny population, bring in capitalists can considerably raise financial task. Basically, offshore financial investment occurs when offshore investors develop a company in an international country. The firm acts as a covering for the financiers' accounts, protecting them from the greater tax concern that would certainly be sustained in their residence country.By making these on-paper possession transfers, people are no more vulnerable to seizure or other domestic problems. If the trustor is a united state local, their trustor condition allows them to make payments to their overseas trust complimentary of income tax. Nonetheless, the trustor of an overseas asset-protection browse around this web-site fund will certainly still be taxed on the count on's income (the revenue made from financial investments under the trust entity), even if that revenue has not been distributed.

These countries have passed regulations establishing strict corporate and also banking discretion. If this discretion is breached, there are serious repercussions for the upseting party. An instance of a breach of financial discretion is divulging customer identities. Divulging investors is a breach of company confidentiality in some territories. Nevertheless, this secrecy does not suggest that overseas financiers are bad guys with something to hide.

From the viewpoint of a high-profile capitalist, nevertheless, maintaining the information, such as the capitalist's identity, secret while building up shares of a public firm can supply that financier a considerable monetary (and lawful) advantage (offshore wealth management). High-profile financiers do not such as the public at big recognizing what supplies they're buying.

9 Simple Techniques For Offshore Wealth Management

The small fry adds the prices. Because nations are not needed to accept the see this website regulations of a foreign federal government, overseas jurisdictions are, in many cases, immune to the laws that may use where the financier resides. United state courts can assert jurisdiction over any type of properties that are situated within united state

Therefore, it is prudent to ensure that the possessions a financier is attempting to shield not be held literally in the USA. On the various other hand (see listed below), possessions kept in international checking account are still regulated under USA legislation. In some nations, regulations limit the worldwide investment possibilities of people.

Offshore accounts are a lot more flexible, providing investors endless accessibility to worldwide markets and also to all major exchanges. In addition to that, there are numerous opportunities in creating countries, particularly in those that are starting to privatize fields formerly under government control. offshore wealth management. China's willingness to privatize some markets, in particular, has capitalists drooling over the globe's biggest consumer market.

Getting The Offshore Wealth Management To Work

While domiciling investments as well as possessions in an offshore territory has benefits, there are likewise downsides to consider. Financial investment income made offshore is currently an emphasis of both regulators and tax obligation go to this site laws.Although the lower business expenditures of offshore business can equate right into better gains for investors, the IRS maintains that United state taxpayers are not to be permitted to escape taxes by moving their specific tax obligation obligation to some international entity. The Organization for Economic Collaboration and Development (OECD) as well as the World Trade Organization (WTO) likewise have guidelines that call for banks to report info concerning their foreign customers, yet each nation abides by these regulations in various ways and also to different levels.

Offshore accounts are not inexpensive to establish up. Relying on the person's financial investment goals and the territory they select, an overseas firm may require to be started, as well as that may imply high lawful charges and also corporate or account registration costs. In some cases, capitalists are needed to own residential or commercial property (a home) in the country in which they have an offshore account or run a holding firm.

Report this wiki page